The Extra and Surplus (E&S) market has grown for 5 consecutive years by double-digit share charges. Whereas growth seems to have slowed, ample development might [DP1] proceed if main tendencies persist, in line with Triple-I’s newest challenge transient, Extra and Surplus: State of the Danger.

As reported by S&P International Intelligence, whole premiums for 2023 reached $86.47 billion, up from $75.51 billion in 2022. The expansion fee for direct premiums in 2023 climbed to 14.5 %, down from the height year-over-year (YoY) enhance of 32.3 % in 2021 and 20.1 % in 2022. The share of U.S. whole direct premiums written (DPW) for P/C in 2023 grew to 9.2 %, up from 5.2 % in 2013.

The transient summarizes how these outcomes are pushed by the area of interest section’s capability to make the most of protection gaps within the admitted market and shortly pivot to new product growth within the face of rising or novel dangers. Evaluation and takeaways, primarily based on knowledge from US-based carriers, spotlight dynamics which will assist continued market growth:

- The rising frequency of local weather disasters and catastrophes that overwhelm the admitted market

- The rising quantity and quantity of outsized verdicts (awards over $10 million)

- The sustainability of amenable regulatory frameworks

- Outlook for the reinsurance section

These elements may converge to boost or worsen circumstances.

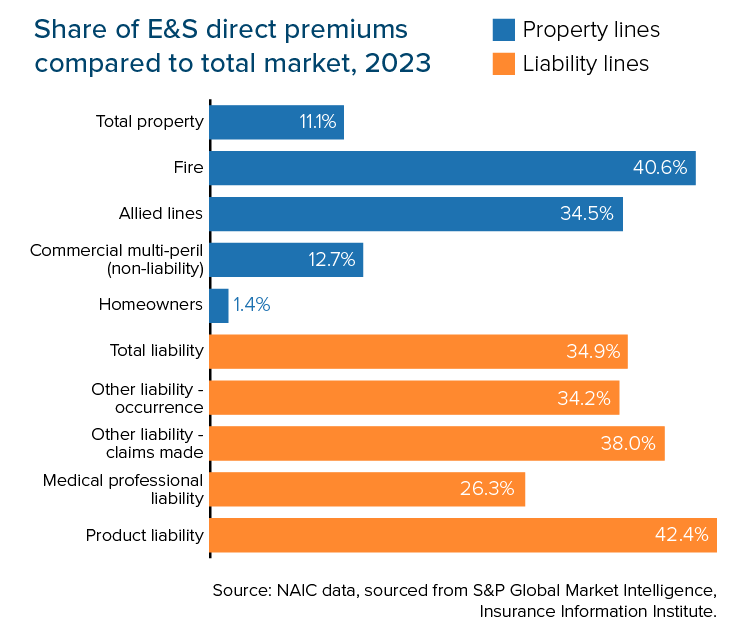

For instance, some states, akin to Florida and California, are coping with vital obstacles to P/C affordability and availability within the admitted market posed by disaster and local weather danger whereas additionally experiencing massive respective shares of outsized verdict exercise. Additionally, 13 of the 15 largest U.S. E&S underwriters for business auto legal responsibility skilled a YoY enhance in 2023 direct premiums written. In distinction, eight of the biggest 15 underwriters of business auto bodily injury protection skilled a decline. Given 2023 analysis from the Insurance coverage Data Institute exhibiting how inflationary elements from authorized prices amplify declare payouts for business auto legal responsibility, it seems that E&S is flourishing off the struggles of the admitted market.

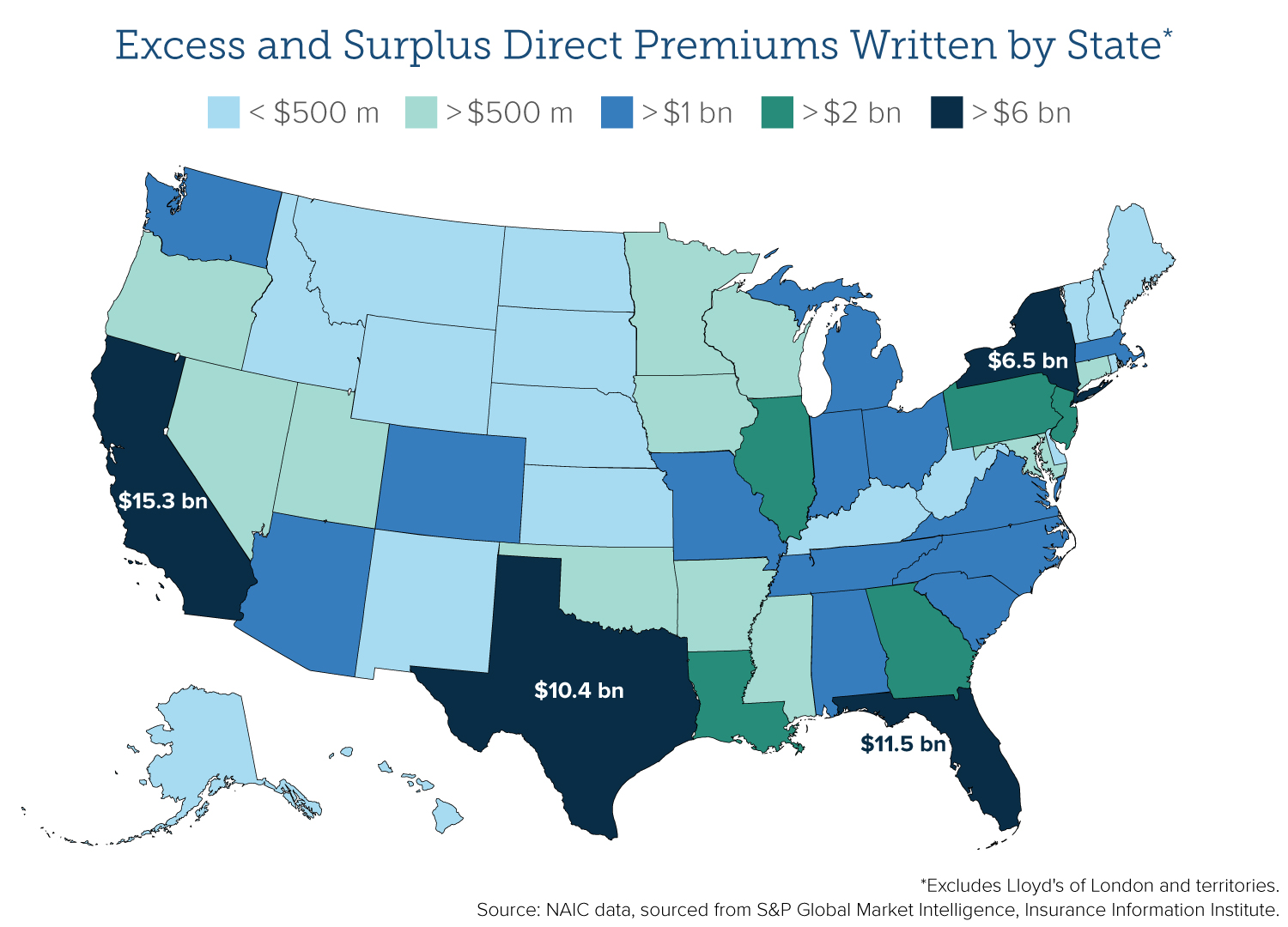

On the state degree, the highest three states primarily based on E&S property premiums as portion of the whole property market had been Louisiana (22.7 %), Florida (21.1 %), and South Carolina (19.4 %) in 2023. The states experiencing the best development charges in E&S share of property premiums had been South Carolina (9.0 %), California (8.8 %), and Louisiana (8.3 %).

For the reason that publication of Triple-I’s transient, AM Greatest launched its 2024 Market Section Report on U.S. Surplus Traces. One of many key updates: after factoring in numbers from regulated alien insurers and Lloyd’s syndicates, the E&S market exceeded the $100 billion premium ceiling for the primary time, climbing previous $115 billion. The share measurement within the P/C market has greater than tripled, from 3.6 % whole P/C DPW in 2000 to 11.9 % in 2023. Findings additionally point out that DPW is concentrated closely throughout the high 25 E&S carriers (ranked by DPW), with about 68% of the whole E&S market DPW coming from this group.

The E&S market sometimes gives protection throughout three areas:

- Nonstandard dangers: potential liabilities which have unconventional underwriting traits

- Distinctive dangers: admitted carriers don’t provide a filed coverage kind or fee, or there’s restricted loss historical past data obtainable

- Capability dangers: the shopper to be insured seeks a better degree of protection than most insurers are keen to offer

Thus, E&S carriers provide protection for hard-to-place dangers, stepping in the place admitted carriers are unwilling or unable to tread. It is sensible that the insurance policies sometimes include increased premiums, which might increase DPW.

Nevertheless, the worth proposition for E&S policyholders hinges on the shortage of protection within the admitted market and the insurer’s monetary stability – particularly since state warranty funds don’t cowl E&S insurance policies. Subsequently, minimal capitalization necessities are likely to increased for E&S than for admitted carriers. Rankings from A&M Greatest over the previous a number of years point out that almost all surplus insurers stand safe. Sturdy underwriting and robust reinsurance capital positions will play a job available in the market’s capability for continued growth.

To be taught extra, learn our challenge transient and observe our weblog for the most recent insights.