Triple-I’s newest Points Transient, Lloyd’s: Developments and Insights, spotlights one of many world’s main specialist insurance coverage and reinsurance marketplaces. The transient explains how the practically 350-year-old platform has functioned otherwise from the widespread stand-alone mannequin whereas evolving into an integral supply of capability and resilience for the worldwide Twenty first-century danger panorama.

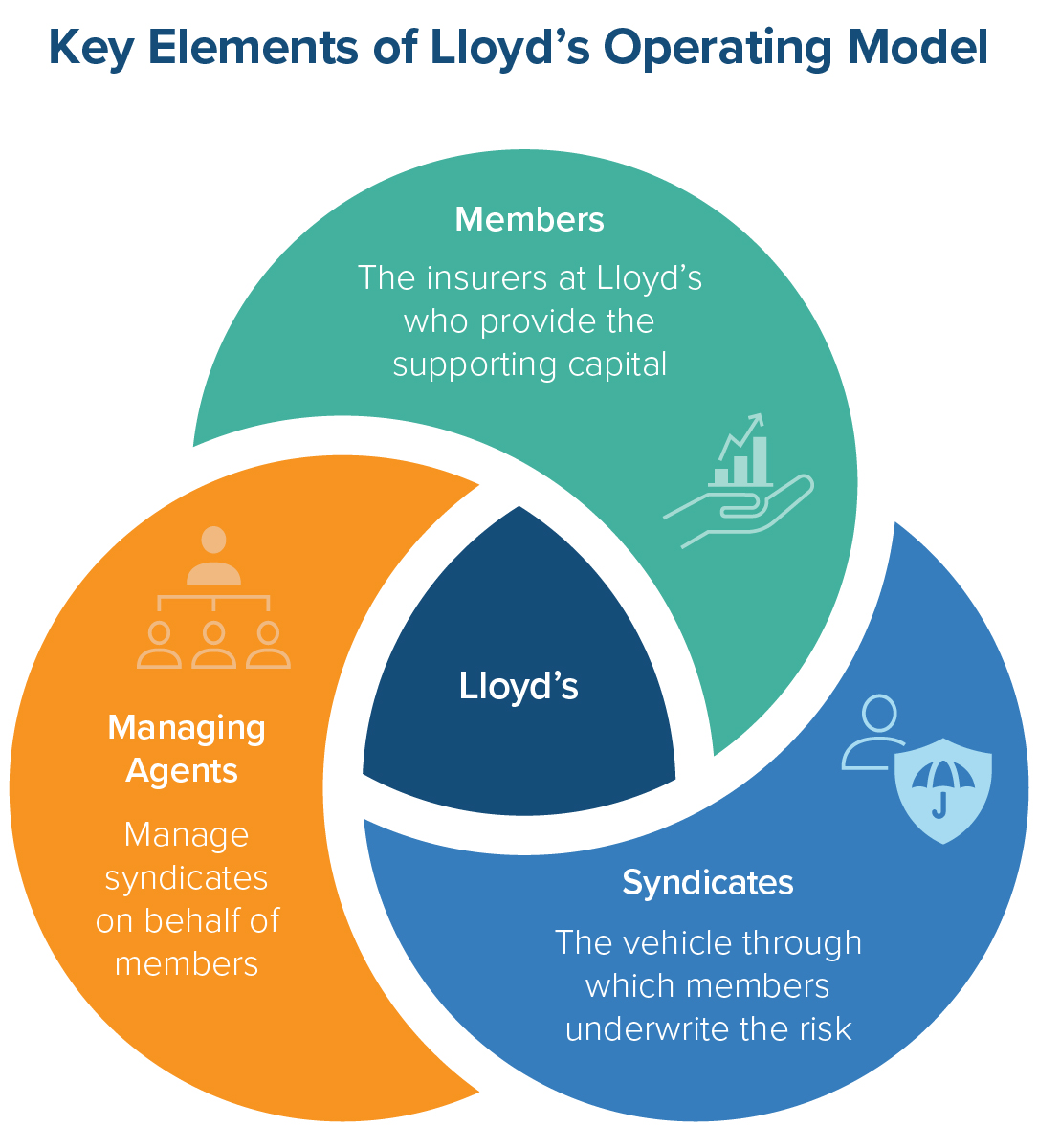

Opposite to a typical misperception, Lloyd’s is just not a single insurer; somewhat it’s a market – i.e. hub, community, platform – connecting danger brokers, underwriters, and capital suppliers who negotiate the switch of danger. It consists of three core teams:

- Members: Individuals or company entities that present the capital that funds a syndicate.

- Syndicates: An accounting assemble with property, liabilities, and Revenue and Loss (P&L) assertion segregated from these of different Lloyd’s syndicates.

- Managing Brokers: Entities appointed by syndicate members to deal with underwriting and claims, in addition to oversee the governance and operations on behalf of the syndicates.

The association permits insurance policies to have a number of underwriters, enabling every underwriter to tackle extra danger than they’d have the urge for food for as a sole underwriter. In consequence, complicated and hard-to-place dangers may be lined.

One other distinctive characteristic of Lloyd’s is its capital construction, also referred to as the “Chain of Safety.” The transient explains how the Chain of Safety is designed to offer the monetary backing for all insurance coverage insurance policies written at Lloyd’s. On account of this setup, the main score companies usually apply a single monetary power score (FSR) to all of the insurance policies written via Lloyd’s, no matter which syndicates take part within the coverage.

Profitable dealing with of long-tail and complicated dangers – the place claims could emerge many years later – may be very important to fostering confidence within the bigger insurance coverage business. All through its lengthy historical past, Lloyd’s has been known as upon to soak up excessive and sudden losses whereas paying claims and recapitalizing. This monitor report contains enjoying a key position in supporting U.S. financial restoration, from main disasters, such because the 1906 San Francisco earthquake, the September 11 assaults, Hurricane Katrina, and more moderen hurricanes and wildfires.

Managing uncertainty in in the present day’s fast-evolving danger panorama can require retaining abreast of interconnected threats that outpace conventional danger administration methods. Insurers and danger managers can enhance the prediction and prevention of rising threats throughout core strategic areas:

- advancing analytics capabilities

- strengthening capital resilience

- collaborating throughout the business

Centering these goals, Lloyd’s cultivates channels for expertise improvement, innovation, and new capital flows.

For instance, its London Bridge 2 (LB2) platform provides institutional buyers a versatile and environment friendly means to deploy funds into the Lloyd’s market, attracting roughly $2.5 billion in new capital since its launch in 2022. Lloyd’s training platform helps the sustainable progress of the market by equipping professionals with the perception wanted to navigate the rising danger panorama. And, Lloyd’s Lab – a product improvement accelerator designed to quickly develop, check, and refine new merchandise, ideas, and options – supported 48 U.S. startups, which collectively have raised $490 million to scale options tackling wildfire, flood, and cyber dangers.

The US is Lloyd’s largest market, accounting for roughly half of {the marketplace}’s international premiums. Extra and surplus underwriting accounts for over 60 p.c of Lloyd’s complete premiums written within the U.S. In 2024, this share labored out to $20.8 billion in surplus strains insurance coverage capability, roughly 16 p.c of the complete U.S. surplus strains market. Moreover, Lloyd’s gross written premiums for U.S. reinsurance totaled $9.86 billion in 2024, with {the marketplace} ceding round $2.9 billion yearly in reinsurance premiums to U.S. reinsurers.

This particular version of the Triple-I problem transient collection is a part of ongoing efforts to coach and lift consciousness about how insurance coverage market contributors assist protection affordability and availability.