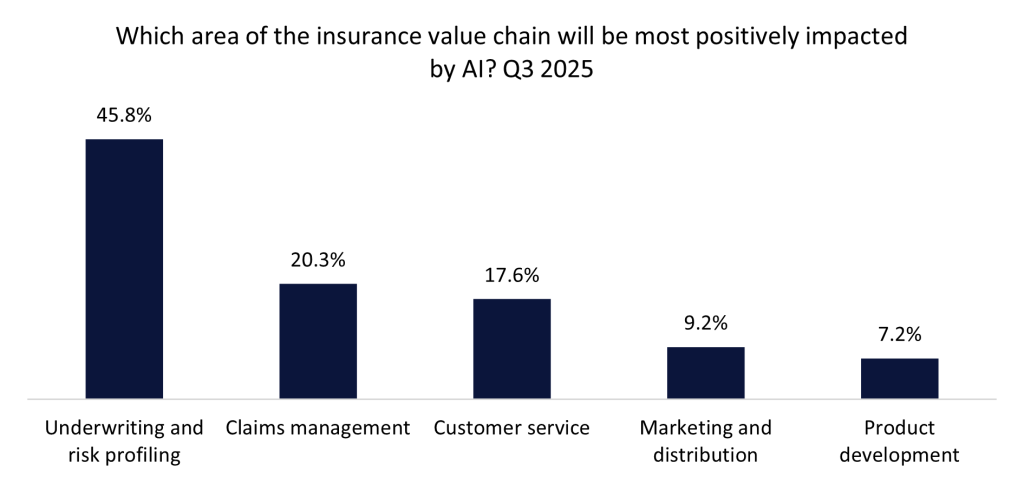

A 2025 ballot performed by GlobalData revealed that just about 50% of respondents imagine that underwriting and threat profiling would be the insurance coverage worth chain areas most positively impacted by AI over the subsequent 5 years. In the meantime, Allianz has launched BRIAN; a generative AI-powered device designed to reinforce effectivity and velocity in its industrial underwriting operations.

The GlobalData ballot, performed in Q3 2025 on Verdict Media platforms, discovered that 45.8% of individuals recognized underwriting and threat profiling because the sectors inside the insurance coverage worth chain most definitely to profit from AI. This displays a confidence in AI’s potential to streamline decision-making processes and enhance pricing accuracy.

Which space of the insurance coverage worth chain can be most positively impacted by AI? Q3 2025

Following a profitable pilot part that concerned almost 3,000 questions from 190 customers, Allianz’s BRIAN is now totally operational and has been rolled out to extra underwriting groups. The device has saved roughly 135 working days in data gathering because it was rolled out in January 2025; demonstrating its functionality to offer correct and constant responses which liberate priceless underwriting sources. That is significantly helpful for junior underwriters because it accelerates their studying and fosters consistency in decision-making throughout the group.

The implementation of BRIAN illustrates how AI can alleviate the burdens of historically guide processes; enabling underwriters to focus on higher-value duties, equivalent to threat evaluation, pricing refinement, and relationship administration. Going ahead, different insurers ought to take into account experimenting with AI in high-impact areas of the worth chain. By piloting new instruments, measuring productiveness beneficial properties, and scaling profitable options, they’ll preserve competitiveness as AI turns into an increasingly-vital differentiator in underwriting and customer support.