In 2022, the index sank 25% earlier than a sustained rebound. And through the international monetary disaster, it plunged as a lot as 57% — after which took 4 years to totally recuperate.

Above Key Ranges

The S&P 500’s 200-week shifting common has been a robust indicator of the index’s flooring because the flip of the century. Extra not too long ago, the benchmark bounced again after hitting it through the financial progress scare in 2016, the U.S.-China commerce struggle in 2018 and once more in 2022.

This time round, it got here nowhere close to that threshold even at its lowest level.

Whereas that additionally signifies how a lot additional the index might hunch in a renewed selloff, it exhibits that buyers have been assured sufficient to swoop in nicely earlier than the market examined a brand new backside.

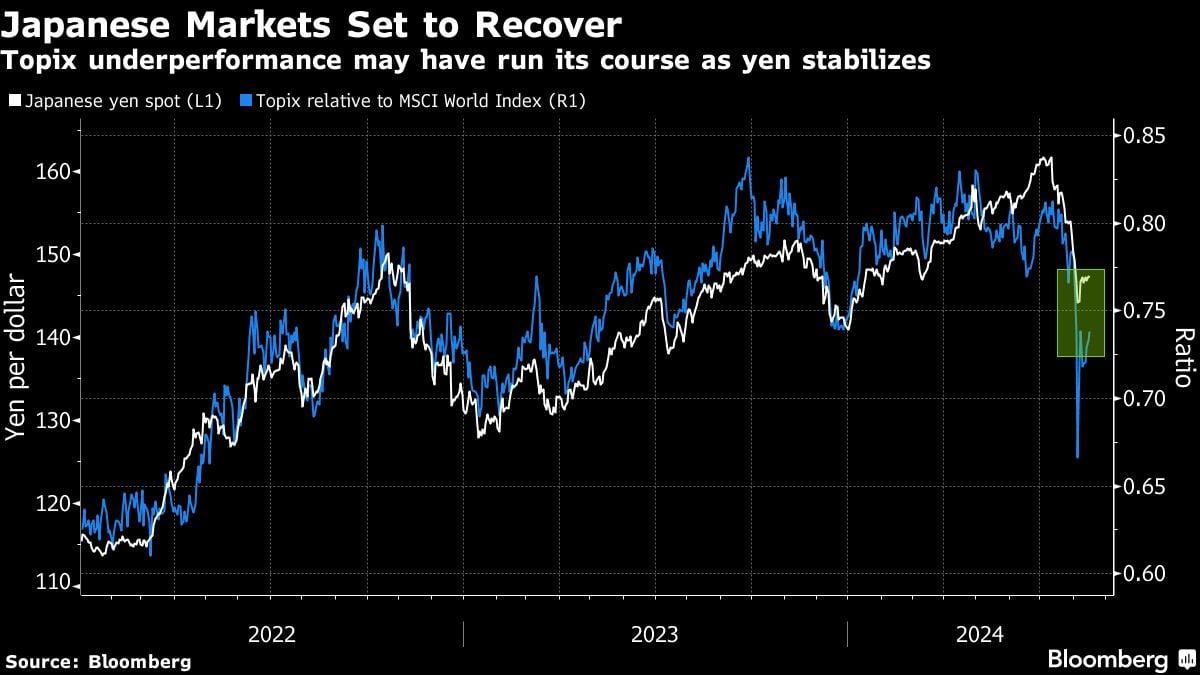

Japan Rebounding

Japan was on the coronary heart of the worldwide turmoil after its financial coverage tightening despatched the yen to one in all its strongest ranges this yr, driving hedge funds to dump belongings to unwind carry trades financed by low-cost loans in Japan.

The foreign money is now easing once more as a result of policymakers there have been fast to reassure markets that additional price hikes have been probably off the desk. That’s flowed by to shares in Japan, too.

Warning Signal

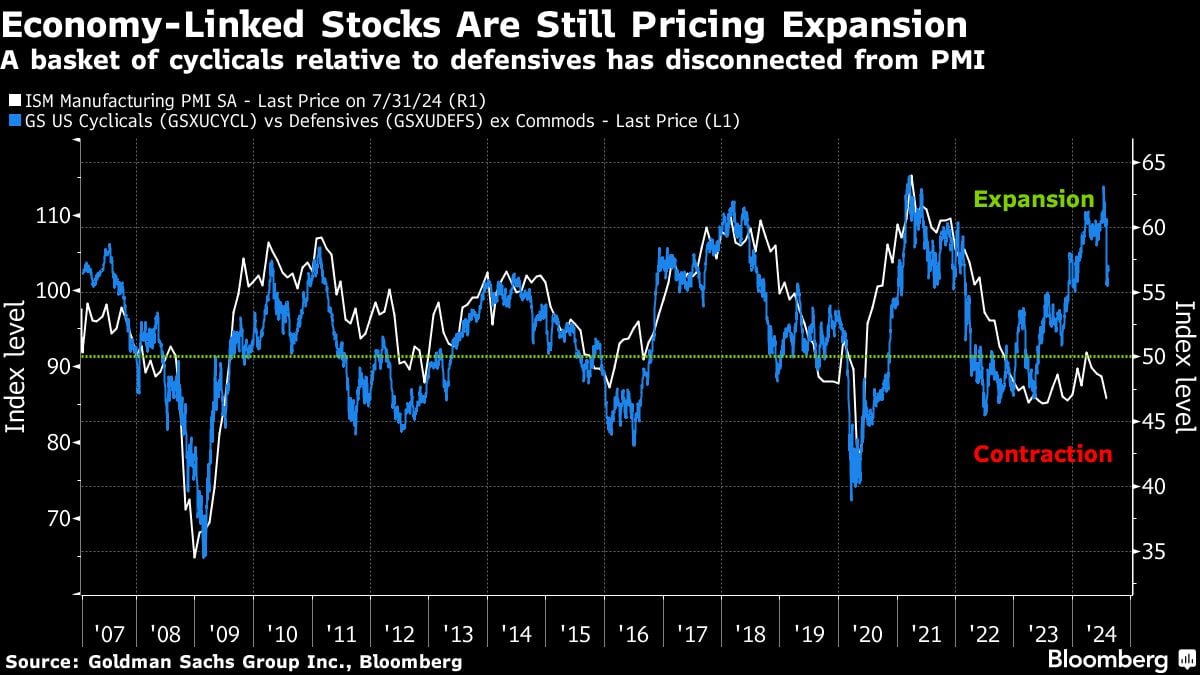

Alternatively, the financial threat that the Fed has waited too lengthy to begin reducing charges hasn’t gone away. So the latest rebound implies that extra of a tender touchdown is being priced in, exposing the market to a different slide if that proves off base.

One measure of what buyers are relying on can been seen in how shares linked to the financial cycle — or so-called cyclical sectors — are faring relative to their less-exposed friends.

Within the U.S., a Goldman Sachs Group Inc. basket that measures the relative transfer between the teams exhibits that whereas cyclicals have trailed defensives not too long ago, they’re nonetheless priced for an financial growth.

On Thursday, the unexpectedly massive bounce in retail gross sales lent credence to that view. However earlier figures have additionally pointed to a cooling in job progress and declining exercise within the manufacturing sector.

“Certainly not am I hitting the panic button right here, however in contrast with different asset lessons, the S&P 500 appears to have priced in little or no uncertainty,” mentioned Matt Stucky, chief fairness portfolio supervisor at Northwestern Mutual Wealth Administration.

(Credit score: Adobe Inventory)